Understanding the 4 Phases of the Real Estate Cycle in 2023

Understanding the real estate cycle is a game-changer for investors and professionals in the industry. The ability to predict trends, make informed decisions, and time investments can significantly impact the success of your real estate endeavors. Let’s explore the four phases of the real estate cycle and how you can navigate them to maximize your returns in 2023.

Key Takeaways

Real estate cycles are important for informed investment decisions.

Analyzing indicators and exercising caution can help predict future trends.

Different strategies should be applied to each phase of the real estate cycle, such as rehabbing properties or buy and hold investments in multifamily units.

The Importance of Real Estate Cycles

There are various stakeholders in the industry, such as:

real estate agents

real estate investors

buyers

renters

They rely heavily on real estate cycles. Grasping these cycles thoroughly can pave the way for accurate predictions of upcoming trends and improved investment decisions.

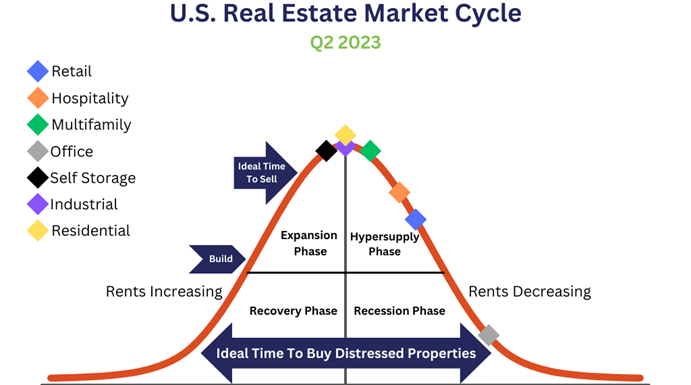

As of 2023, the property cycle is in the expansion phase, shaped by national economic trends. A thriving economy marks this phase, driving up real estate prices in sync with escalating wages and job growth.

Predicting Trends

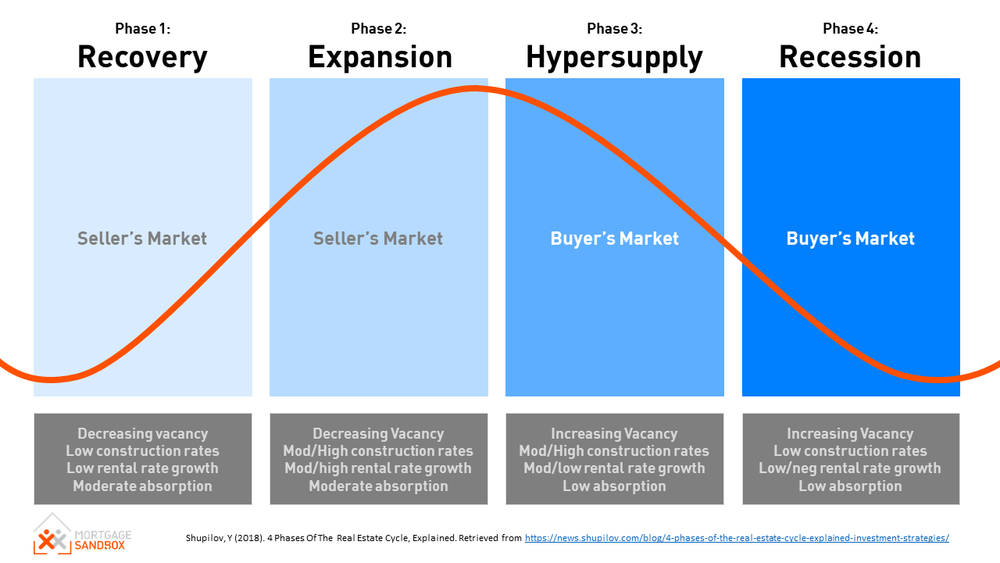

Real estate cycles, also known as real estate market cycle, offer valuable insights into future market trends, such as rent growth and demand for housing. Comprehending the four phases of the real estate cycle equips investors to seize profitable opportunities and refine their investment decisions. The four phases are:

Recovery

Expansion

Hyper supply

Recession

Forecasting real estate market trends typically involves analyzing various indicators, including:

The House Price Index (HPI)

Demographic changes

Interest rates

Monthly house price developments

Nonetheless, exercising caution while making predictions and contemplating multiple sources of information is advisable since the precision of predictions in real estate market trends can vary, and they should never be the sole point of reliance.

Timing Investments

The recovery and expansion phases of the real estate cycle present the best opportunities for property investment. These phases are characterized by market growth and escalating property prices, thus being the perfect time to invest.

When considering the optimal time to sell, keep in mind factors such as:

market conditions

economic indicators

supply and demand

personal circumstances

professional advice

The most advantageous time to invest in rental properties is during a slowdown or dip in prices, as sellers are more motivated to sell, and properties may be available at a lower price.

Factors Influencing Real Estate Cycles

A myriad of factors come into play in shaping real estate cycles, encompassing demographics, interest rates, the general economy, government policies, and consumer confidence.

Key economic indicators like GDP growth, unemployment rate, and consumer confidence significantly steer the real estate market. A robust economy boosts consumer confidence in residential real estate purchases, leading to thriving residential real estate markets and a healthy housing market.

Moreover, interest rates have an inverse relationship with the demand for real estate, affecting the market’s investment activities.

The Four Phases of the Real Estate Cycle

The real estate cycle, also known as the housing market cycle, is divided into four stages:

Recovery

Expansion

Hyper supply

Recession

Each phase of the cycle comes with distinctive characteristics and investment opportunities that we will delve into in the following subsections.

Recovery Phase

The recovery phase is the initial stage of the real estate cycle, characterized by flat rental growth and signs of economic revival. During this phase, investors should vigilantly monitor the market for any indications of recovery and take advantage of properties offered at below-market value, regardless of their financial or physical condition.

Investors can leverage the remainder of the recovery period by working on enhancing these properties’ value and then selling or renting them out as the economy starts to expand. Typical indicators associated with this phase include:

Low occupancy rates

Lukewarm housing demand

A decrease in development projects

Stagnant rental growth

Expansion Phase

The expansion phase is marked by increased demand, rising prices, and a strong economic climate. This is an advantageous time to purchase properties, as prices are more likely to increase as the market progresses to the subsequent phase.

However, attempting to time the market and purchase at the peak of the expansion phase carries considerable risk. During the expansion phase, investors can take advantage of attractive pricing while observing key indicators that the market is becoming more active. Some beneficial strategies during this phase include:

Low-cost financing

Constructing new properties

Renovating existing ones

Acquiring value-add investment properties

Hyper Supply Phase

The hyper supply phase occurs when the supply of real estate exceeds demand, leading to decreased prices and a more prudent investment strategy. During this phase, investors with limited cash reserves should consider liquidating their holdings to avoid a potential decrease in property value in the subsequent phase.

Conversely, investors who possess properties with reliable tenants and long-term leases may be better served by maintaining their current positions and weathering the upcoming recession. Rental rates may remain elevated due to favorable economic conditions, but vacancy rates will begin to increase.

Some indicators of entering the hyper supply phase include an increase in housing supply that exceeds demand and market saturation with available properties.

Recession Phase

The recession phase witnesses a drop in demand for real estate space and investment along with declining rents and a negative impact on capital values. Despite this, the phase opens up the opportunity to acquire distressed real estate at bargain prices.

Investors may wish to consider purchasing bank-owned or foreclosed real estate at reduced prices. Some strategies to consider during a recession include monitoring signs of economic recovery and exploring opportunities to acquire properties at reduced prices, such as bank-owned or foreclosed real estate. However, investing during a recession is considered high-risk due to reduced market liquidity and demand.

How Long Does a Typical Real Estate Cycle Last?

Real estate cycles, such as the average real estate cycle, usually span approximately 18 years, with the current cycle having commenced shortly post the Global Financial Crisis in 2008. Nonetheless, the duration and phases of real estate cycles can be unpredictable, being swayed by a host of factors.

It is crucial for investors to remain vigilant and adaptable to market changes to optimize their investment strategies during different real estate cycles.

Investment Strategies for Each Phase

Successful real estate investment in the dynamic real estate market calls for the deployment of diverse strategies suited to each phase of the real estate cycle. These strategies encompass rehabbing properties, the buy and hold strategy, and multifamily investments, all of which contribute to a smart approach to purchase real estate.

We will now delve into these strategies in greater detail.

Rehabbing Properties

Rehabbing properties involves buying undervalued properties, making improvements, and selling them for a profit during the expansion phase. This process aims to increase the condition and value of the property through renovations or upgrades. Rehabbing can yield significant returns due to heightened demand, appreciation potential, rental income, and market activity.

Suitable properties for rehabbing in the real estate sector include:

Single-family homes

Multi-family properties such as duplexes and apartment buildings

Retail venues

Office buildings

Mixed-use spaces

Buy and Hold Strategy

The buy and hold strategy involves purchasing properties during the recovery phase and holding onto them for long-term appreciation. This investment approach offers potential benefits such as long-term growth, passive income, and tax advantages. However, it also carries potential risks such as market downturns, tenant turnover, and unexpected maintenance costs.

To effectively implement the buy and hold strategy, follow these steps:

Conduct research on the local market.

Identify properties with potential for appreciation.

Purchase properties during the recovery phase.

Consider hiring a property manager to assist with property management.

Multifamily Investments

Multifamily investments refer to properties that contain multiple units, such as apartment buildings. These investments can provide a steady cash flow and potential for appreciation throughout the real estate cycle, making them a potentially beneficial option.

Multifamily investments offer the following benefits:

Steady cash flow due to increased occupancy and more tenants paying rent, ensuring a reliable and consistent cash flow.

Lower vacancy risk compared to single-family homes.

Potential for long-term appreciation, allowing investors to sell the property at a higher price in the future and realize a capital gain.

Summary

In conclusion, understanding the real estate cycle and its four phases – recovery, expansion, hyper supply, and recession – is crucial for making informed investment decisions and predicting market trends. By employing various investment strategies such as rehabbing properties, the buy and hold strategy, and multifamily investments, investors can maximize their returns and minimize risks throughout the real estate cycle. Stay vigilant, adaptable, and proactive to succeed in the ever-changing real estate market.

For Texas housing market predictions, see our blog: https://www.quickcommissionadvance.com/blog/texas-housing-market-predictions/

Frequently Asked Questions

What are the 4 cycles of real estate?

Real estate cycles involve four main phases: recovery, expansion, hyper-supply, and recession. These stages form an ongoing cycle with no sustained expansion or hyper-supply period without an eventual recession followed by recovery.

What is the real estate building life cycle?

The real estate building life cycle is composed of four distinct phases: recovery, expansion, hyper supply, and recession, as well as the three broad phases of acquisition, operation, and disposition.

What is an 18.6 real estate cycle?

An 18.6 real estate cycle typically consists of 14 years of upmarket trends followed by four years of downmarket trends, divided into two seven-year segments and a “Winner’s Curse” period for the final two years.

What factors influence real estate cycles?

Real estate cycles are affected by demographics, interest rates, the economy, government policies, and consumer confidence.

Which phase of the real estate cycle is the best for investing in property?

Investing in property during the recovery and expansion phases of the real estate cycle is the most optimal option for successful returns.