As we dive into the third quarter of 2023, it’s time to take a look at the fascinating landscape of Texas housing market predictions. Texas, known for its vast landscapes, diverse cities, and booming economy, has always been a vibrant hub for real estate activity. However, this year, like no other, is witnessing a whirlwind of changes and trends that are stirring up thoughts about the future of the housing market in the Lone Star State.

Brief introduction to the Texas housing market.

Overview of the housing market trends seen in the first and second quarter of 2023.

State of the Texas Housing Market at the Start of Q3 2023

Review of current median home value in comparison to the previous year.

Discussion about the high demand for homes and the typical period for properties to go into pending sales.

Key Performance Indicators and Trends

Exploration of the median sale price to list ratio and the percentage of sales closing above the list price.

Review of the trends in single-family construction permits and construction starts.

Analysis of active listings and their impact on housing inventory and availability.

Detailed Analysis of Single-Family Home Market

Deep dive into the single-family home market in Texas, considering recent data and trends.

Understanding the role of single-family homes in the Texas market.

Major Metropolitan Areas and Top Real Estate Hotspots

Review of several major metropolitan areas with promising appreciation rates.

Discussion about the top 10 places to buy a house in Texas and the top 10 cities with the highest real estate appreciation rates since 2000.

Expected Challenges in Q3 2023

Discussion about potential challenges, including inflation and the possibility of a recession.

Analysis of how these challenges may impact the Texas housing market.

Opportunities to Look Forward to in Q3 2023

Analysis of forecasted growth and appreciation for the Texas housing market.

Discussion about emerging opportunities for buyers, sellers, and investors in the Texas market.

Conclusion

Summary of the key points discussed in the article.

Final thoughts and observations on the predictions for the Texas housing market for Q3 2023.

Introduction

The predominant questions that appear to be on everyone’s minds are: Are home prices dropping in Texas? and: When will housing prices drop in Texas? To answer these questions, we must closely examine the current dynamics and underlying factors shaping the Texas market.

As we entered 2023, the Texas real estate market continued its upward trajectory, fueled by solid demand and limited supply. Property values in Texas saw a significant surge, leaving many potential buyers and investors anxious about the sustainability of these rising trends.

However, given the current economic conditions and the booming growth of Texan cities, it doesn’t seem likely that home prices will drop in the immediate future. The ongoing population growth, coupled with the economic resiliency of most markets in the state, continue to drive demand, thereby putting upward pressure on property prices.

Like the previous year, the Texas real estate market in 2023 appears to be a seller’s market. With the inventory of homes remaining low, sellers often find themselves in favorable positions with multiple offers and bids exceeding the asking price. These market conditions have, in turn, led to an appreciation in property values, causing a significant increase in median home prices.

Are home prices dropping in Texas? This is a question that is often asked hopefully by first-time homebuyers and investors waiting on the sidelines for more favorable market conditions.

However, the solid economic fundamentals and ongoing demand indicate that a substantial drop in home prices is unlikely to occur in the near future. This isn’t to say that the market won’t adjust, but a significant decrease in home prices, such as those witnessed during the last housing bubble, seems improbable given that economic uncertainty isn’t much of a factor in regard to the current circumstances of the housing market.

The future of the Texas market still hinges on several variables. These include potential changes in interest rates, the health of the broader U.S. economy, and the eventual return to normalcy, post-pandemic. Any significant shifts in these factors could cause housing price fluctuations.

State of the Texas Housing Market at the Start of Q3 2023

At the onset of the third quarter in 2023, the Texas housing market presented a complex and dynamic landscape. The state continued to see a high demand for properties, with the market’s competitive nature reducing the median time to sell properties to 56 days. This is noteworthy, given that homes typically went pending about 14 days earlier in the year.

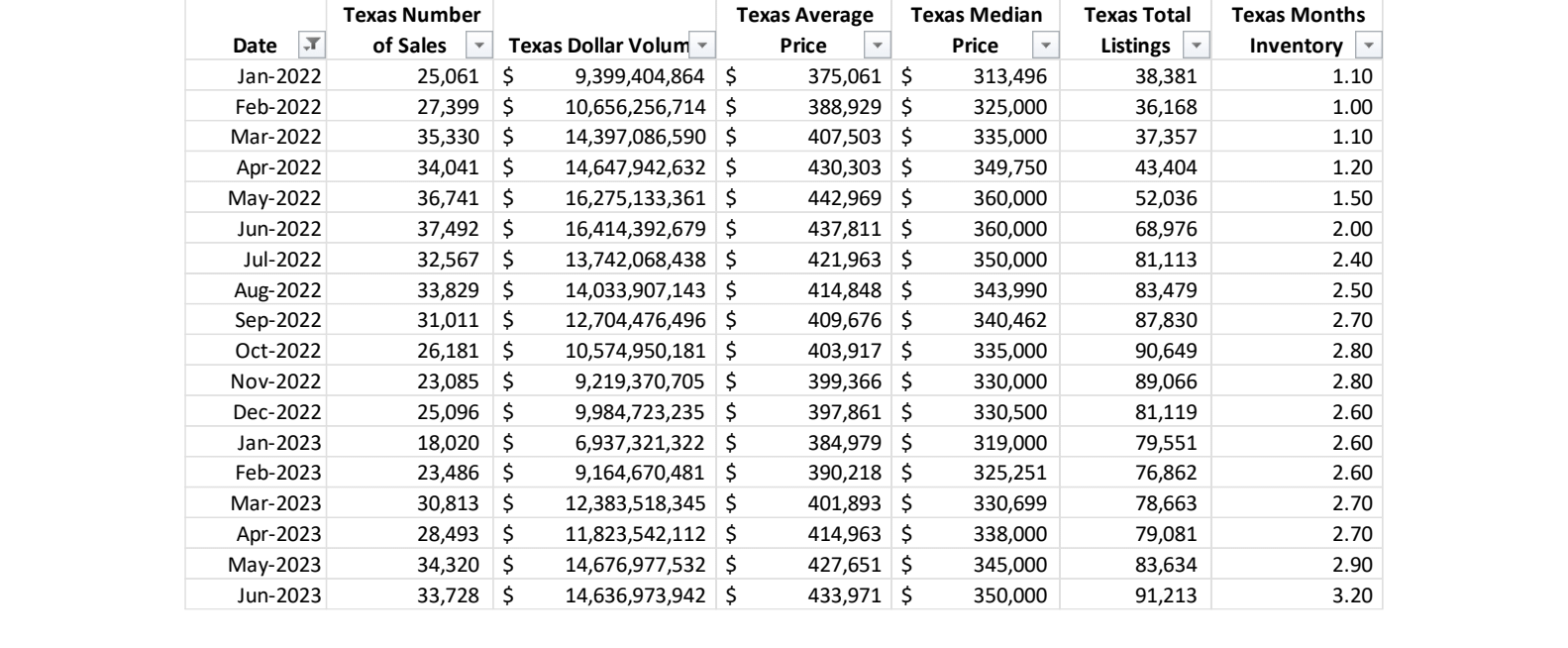

Despite the high demand, the median home price value has slightly decreased over the last year. From a median home price amount of $360,000 in June 2022, we saw a drop to $350,000 by June 2023. This represents a 2.78% decrease, contrasting with a nationwide trend of increasing home prices.

However, this hasn’t dampened the vibrancy of the housing market in Texas, as shown by the total listings, which have grown from 68,976 in June 2022 to 91,213 in June 2023. This implies that despite decreasing home values, sellers are confident in the market, and buyers remain interested.

The number of homes sold in June 2023 was slightly lower than in June 2022 (from 37,492 homes sold to 33,7281 homes sold). Despite this, the dollar volume of sales remained quite consistent, fluctuating a little from $16.4 billion in June 2022 to $14.6 billion in June 2023, indicating that even with fewer sales, the market remains strong.

Looking at the number of months on inventory – a measure of how long it would take to sell all current listings at the current rate of sales – we see that the market has become somewhat less constrained, with inventory rising from 2.0 months in June 2022 to 3.2 months in June 2023. This rise could be due to increased new construction or a cooling of buyer demand.

Despite this mixed bag of statistics, the market demonstrated resilience with a 5.3% increase in home sales from April to May 2023. Furthermore, despite some major metropolitan areas experiencing price drops due to the previous year’s correction, median home prices have consistently grown since January 2023.

The broader economic landscape also plays a part in shaping the Texas real estate market. The state economy remains positive with strong employment growth. The energy sector, a significant driver of the Texas economy, experienced volatility due to crude oil and natural gas price fluctuations. Moreover, potential headwinds such as inflation and a possible recession pose further challenges.

Key Performance Indicators and Trends

The real estate market’s health can be measured using several key performance indicators (KPIs), such as the median sale-to-list price ratio, the percentage of sales closing above the list price, the number of single-family construction permits and starts, and the inventory of active listings.

Median Sale to List Price Ratio and Sales Above List Price

As of the start of Q3 2023, specific metrics on the median sale-to-list price ratio or the percentage of sales indicate closing above the list price for the Texas housing market. However, the consistent rise in the median price throughout 2023 marks a strong seller’s market, suggesting a high sale-to-list price ratio and possibly a significant percentage of homes selling above the list price.

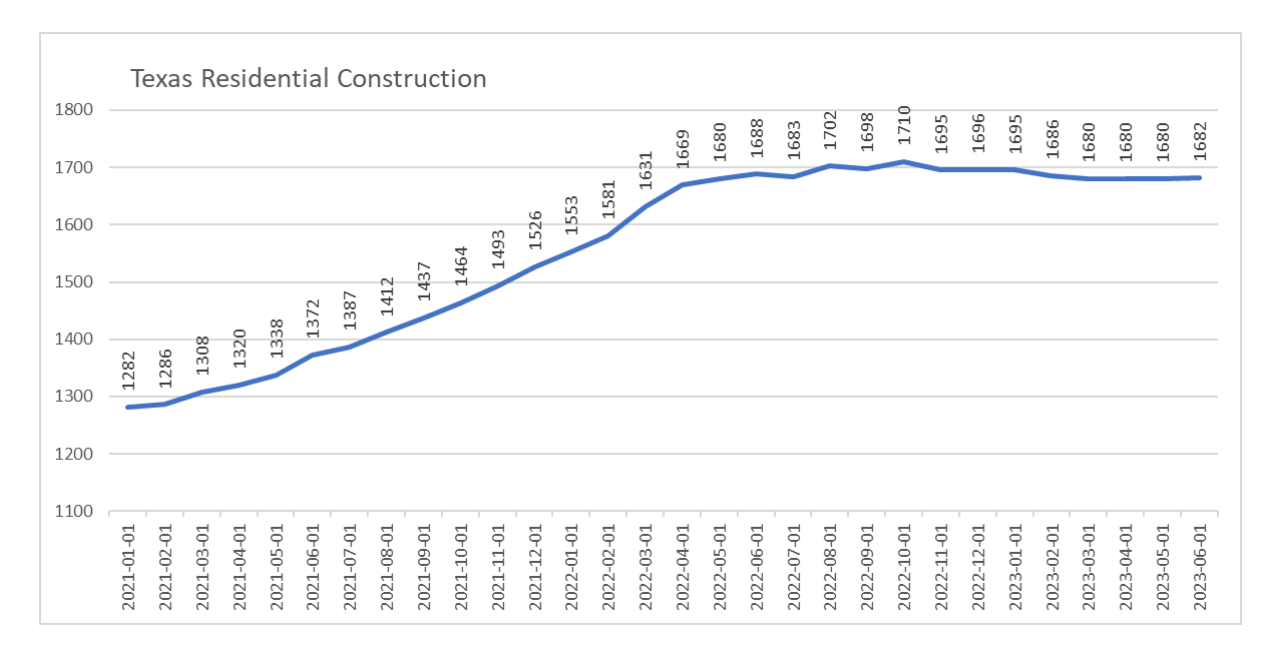

Trends in Single-Family Construction Permits and Construction Starts

There has been an overall decline in the number of construction starts in Texas. For example, the number of dwelling units decreased from 15,248 in January 2022 to 13,831 in May 2023, a drop of around 9.29%. In the same period, the average value per dwelling unit increased from $238,300 to $270,800, marking an increase of 13.64%. It is worth noting that this decrease in new construction can add to the supply constraints already being experienced in the Texas market.

Analysis of Active Listings and The Impact on Inventory Availability

Active listings in the Texas housing market have consistently increased from January 2022 (38,381) to June 2023 (91,213). However, due to the high demand for homes in Texas, the months on inventory have remained relatively low.

Although there’s been an increase from 1.10 months on inventory in January 2022 to 3.20 months on inventory in June 2023, it’s still a seller’s market, which typically has less than six months on inventory. This limited inventory has likely contributed to the increased home prices observed over the same period.

It’s important to note that while these KPIs provide valuable insights into the state of the Texas market, they are influenced by various factors such as economic conditions, interest rates, and local market dynamics. Thus, it’s necessary to consider these trends in the context of the broader economic environment.

Detailed Analysis of the Single-Family Real Estate Market Trends

The single-family home market plays a pivotal role in the broader Texas housing market, and it has been experiencing considerable fluctuations and adjustments recently. This section summarizes this dynamic market, utilizing the most recent data to identify trends and potential future directions.

Sales Performance

The number of sales for single-family homes in Texas showed a notable uptick in March, May, and June 2022, with 35,330, 36,741, and 37,492 units sold, respectively. This can be attributed to an upsurge in buyer interest during the spring season, typically a high time for real estate activity.

However, a general declining trend in sales was noticed from July 2022 onwards, culminating in the lowest sales volume of 18,020 units in January 2023. The market bounced back in February and March 2023 but remained slightly muted compared to the previous year’s high points.

Pricing Trends

The average price of single-family homes in Texas has steadily increased from $375,061 in January 2022 to $433,971 in June 2023. The median price showed a similar uptrend, rising from $313,496 in January 2022 to $350,000 in June 2023. This price growth could be due to increasing demand, constrained supply, and broader economic factors like inflation.

Inventory and Market Balance

The Total Listings and Months on Inventory figures provide insight into the market’s balance between supply and demand. As the number of listings increased from 38,381 in January 2022 to 91,213 in June 2023, the Months on Inventory also witnessed a rise from 1.1 to 3.2, indicating a shifting balance from a seller’s market to a more balanced market situation.

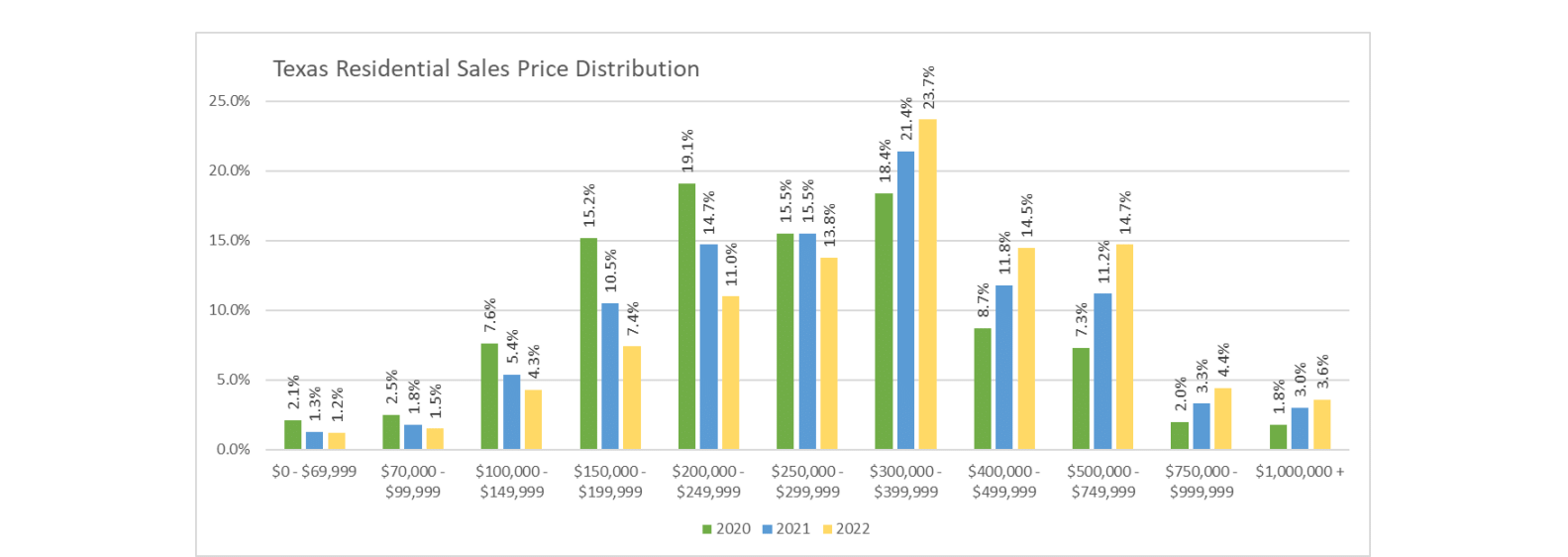

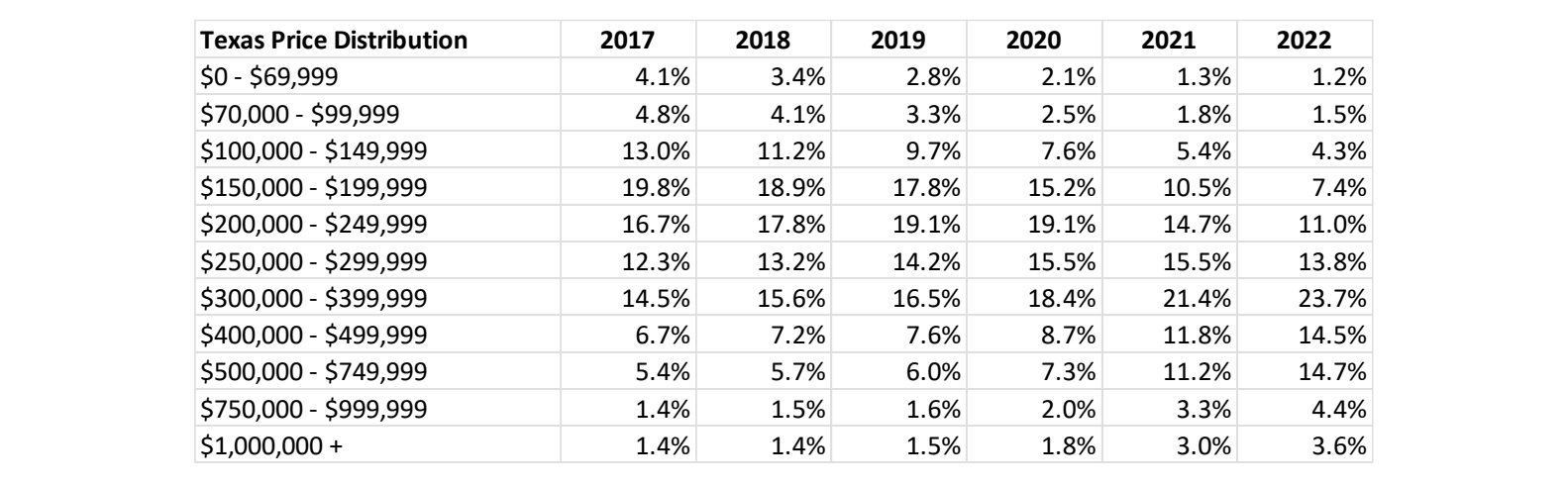

Sales Price Distribution

The sales price distribution table reveals a shift towards higher-priced properties over time. For instance, the percentage of homes sold in the $300,000 – $399,999 price range increased from 18.4% in 2020 to 23.7% in 2022. Similarly, the sales of homes priced at $400,000 – $499,999 price range and the $500,000 – $749,999 price range, also rose in this period. The number of homes which sold under $200,000 has consistently decreased, underscoring the upward shift in home prices.

Overall Market Outlook

According to a report on the Texas housing market, the state has been experiencing fluctuations and adjustments in 2023, with significant interest from potential buyers. The median time to sell properties has decreased, indicating a competitive market and the supply of homes has receded after a two-year boom, leading to shorter market times and limited inventory.

Despite facing challenges like inflation and a potential slowdown in job growth, the Texas market is expected to remain stable and is expected to see home prices show modest appreciation, making it a favorable long-term real estate investment.

Major Metropolitan Areas and Top Real Estate Hotspots

This section presents an overview of Texas’s major metropolitan areas and top real estate hotspots. These areas’ real estate market dynamics will be analyzed with a particular focus on potential appreciation rates and investment opportunities.

Major Metropolitan Areas

Houston

As the most populous city in Texas, Houston offers a strong job market, affordable housing, and a growing population, which are all significant factors contributing to positive real estate trends. This combination of factors makes Houston an attractive location for homebuyers and real estate investors.

Dallas

Known for its economic diversity, Dallas also boasts a strong job market and a robust housing market. The city’s steady population and employment growth continue to fuel its housing demand, making it a top choice for real estate investment.

Austin

With a booming economy, a diverse job market, and a strong rental market, Austin presents an exciting opportunity for real estate investment. The city’s cultural attractions and favorable tax environment also add to its appeal.

Top Places to Buy a House in Texas: Housing Market Predictions

The top places to buy homes are Houston, Dallas, and Austin. Indicators show that these three cities can be considered among the best places to buy real estate in Texas. Strong job markets, increasing population, and positive real estate trends characterize all three of them. The same factors make these cities attractive to both national and foreign real estate investors.

Expected Challenges in Q3 2023

This section outlines the potential challenges facing Texas’s housing market in Q3 2023. These include inflation, the possibility of a recession, high mortgage rates, and the ongoing issue of home affordability.

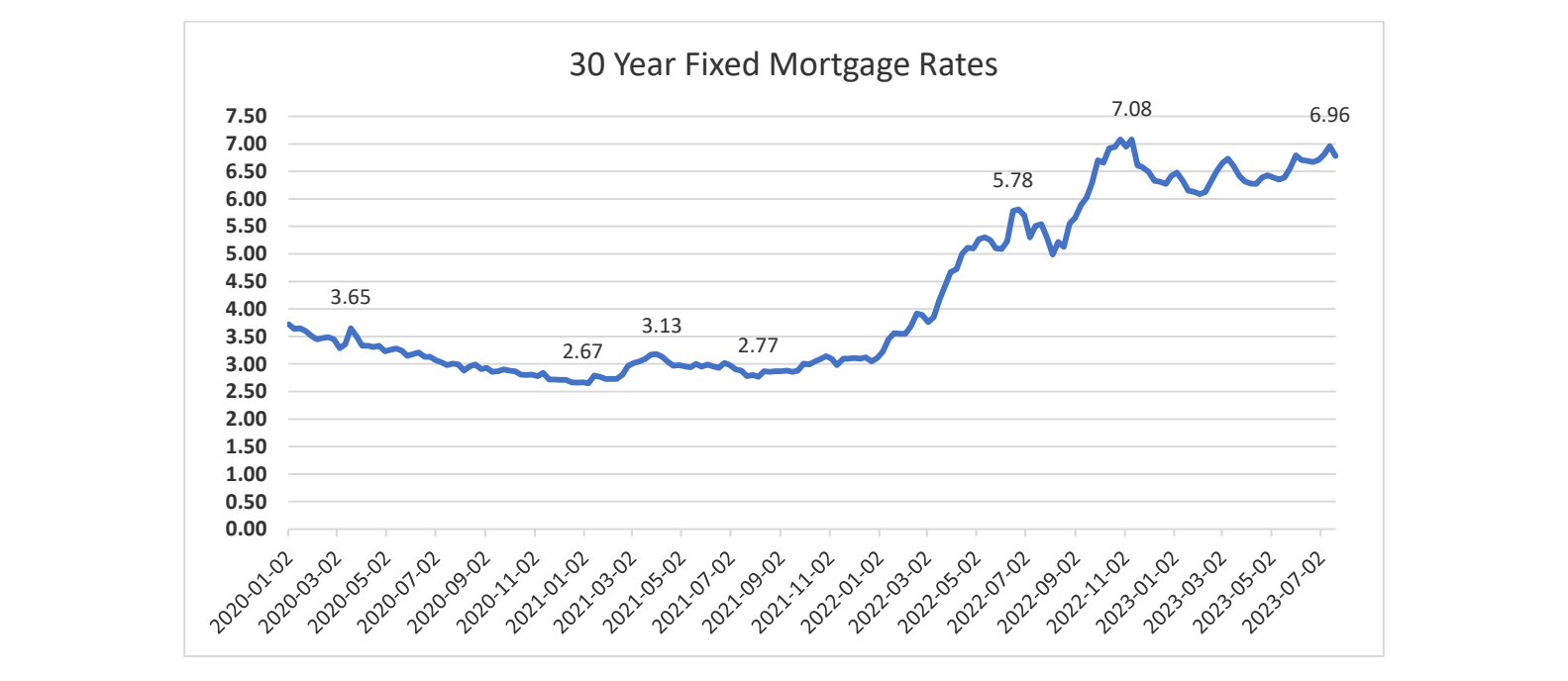

Inflation and higher interest rates, due to the Federal Reserve’s aggressive increases, have led to higher mortgage interest rates (as per the data), contributing to inflation and affordability concerns in the market. In Texas, these concerns may slightly dampen housing market predictions in terms of growth. This is due to the fact that higher mortgage rates can lead to less borrowing and, therefore, lower home purchases.

Possibility of a Recession

While there are concerns about a potential recession, it is worth noting that Texas’s robust demographics and low tax environment make it less likely to be significantly affected by an economic downturn. It is also highly likely that the influx of businesses moving to Texas will continue stimulating the local economy and potentially help counterbalance broader economic pressures.

Home Affordability and Inventory

Existing home sales have been relatively flat, and the inventory supply remains tight, leading to high home prices and ongoing housing affordability issues. While new home construction partially addresses this concern, it is not enough to offset the lack of inventory.

This situation can cause challenges for homebuyers in Texas, particularly first-time buyers who may find it increasingly difficult to afford homes in the more desirable markets.

Despite these potential hurdles, the Texas housing market predictions indicate that the state is expected to remain a growth engine in the national real estate landscape. The housing market is likely to adjust without crashing, and a significant increase in foreclosures is not anticipated for 2023.

In response to these challenges, experts recommend that prospective buyers, and sellers remain prepared and flexible, working with knowledgeable local realtors for an edge in the competitive market. Buyers should base their decisions on their budgets and needs rather than waiting for a potential price decline. Sellers, meanwhile, are advised to price their homes appropriately, prepare early, and enhance their online curb appeal.

Opportunities to Look Forward to in Q3 2023

The Texas housing market has demonstrated resilience and growth both before and after the pandemic, and these trends are projected to continue into Q3 2023. This growth, alongside continued demand and low inventory, presents numerous opportunities for buyers, sellers, and investors alike.

Growth and Appreciation

The Texas market has significantly increased, especially in certain areas like the I-35 corridor between Austin and San Antonio, where people have sought bigger spaces at affordable prices. This growth trend is expected to persist into Q3 2023 and beyond, driven by the continued strong demand for housing. Appreciating land values over time also present investment opportunities, especially in these high-growth areas.

Buyers’ Opportunities

The suburbs of Austin have continued to be popular post-pandemic, providing opportunities for buyers looking for affordable land in desirable locations. Additionally, while current high-interest rates may make the housing market seem unfavorable to buyers, they can actually present potential benefits in the long run. For instance, high-interest rates might cause a slowdown in price growth, making homes more affordable over time.

Sellers’ Opportunities

Given the low inventory and high demand, it is very much a seller’s market in Texas. Sellers can expect to see good returns on their properties, especially if they are located in high-growth areas.

Investors’ Opportunities

For investors, the strong growth and appreciation rates in the Texas real estate market offer opportunities for significant returns. Specifically, real estate investment in rapidly growing areas, such as the suburbs of Austin and along the I-35 corridor, can yield robust profits.

Conclusion

The Texas real estate market has exhibited remarkable resilience amidst an array of challenges, and based on current trends and market predictions, it continues to present exciting opportunities for the third and fourth quarter of 2023.

Our analysis focused on several key elements of the Texas real estate market. The major metropolitan areas such as Houston, Dallas, and Austin continuously attract investors due to their robust economies, affordable housing, strong job markets, and growing populations. Moreover, the trend of high real estate appreciation rates in several Texas cities, as well as the strong presence of businesses and low taxes, lends credence to the notion that the Texas real estate market will remain a growth engine.

It should be noted, however, that like any vibrant market, the Texas real estate landscape is not without its challenges. High mortgage rates and flat existing home sales, brought on by the Federal Reserve’s aggressive rate increases, are leading to affordability concerns. Also to be considered, is the tight inventory housing supply, and the inflation threat which could further complicate the housing market.

Despite these potential hurdles, Texas’s real estate market shows promise, particularly for Realtors. The state’s ongoing appeal to businesses and its status as a hub for growth ensure that it remains a vibrant market for real estate professionals. For Realtors, the high demand for homes, coupled with rapid sales and shorter market times, suggest a landscape ripe with opportunities for growth and success.

As we venture into Q3 2023, the Texas real estate market continues to offer promising prospects for growth, appreciation, and investment. It is a testament to the state’s economic resilience, affirming its reputation as a region of opportunity for buyers, sellers, investors, and Realtors alike. Indeed, the future of the Texas real estate market looks bright.

Leave a Reply