Millennial home buyers are sculpting the housing market with unique trends and purchasing power. Understanding what propels this influential group can unlock new opportunities for real estate agents. This article provides a no-nonsense look at millennial buyers: their typical hurdles, location preferences, and the financing options they gravitate towards.

Key Takeaways

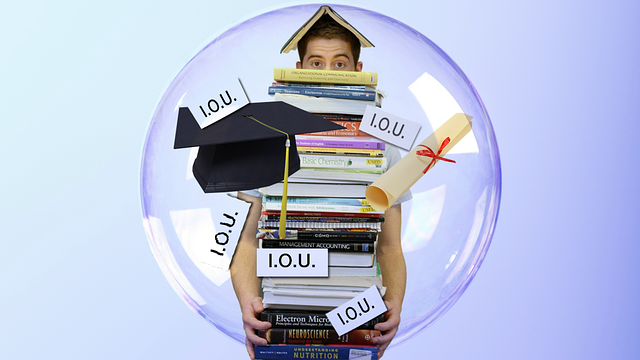

Millennials represent the largest demographic of home buyers with unique purchasing trends, such as buying homes for financial flexibility and pet needs, and they face challenges like student debt and saving for down payments.

Various financing options are available to millennials including conventional loans, FHA loans with lower credit score requirements and down payments, and USDA loans for rural property purchases with zero down payment.

Technology, especially in the form of online home searching and virtual tours, plays a crucial role in millennials’ home buying process, complemented by their appreciation for professional real estate agent support.

Millennial Home Buying Trends

Millennials, along with baby boomers, have a profound impact on the real estate market. Currently, they account for a significant 43% of all home buyers, making them a demographic that mortgage loan officers cannot afford to ignore. This generation represents the fastest-growing demographic of home buyers, especially among first-time buyers. In fact, millennials have been responsible for 47% of all home purchases at Blue Water Mortgage in the past two years, highlighting their increasing involvement in the loan process.

Their preference for real estate ownership has been established by a 2014 Fannie Mae survey, where millennials indicated that owning real estate is a more practical option compared to paying monthly rent. This understanding holds considerable relevance for the real estate market.

Homeownership Rates Among Millennials

Millennials have crossed the 50% mark in homeownership, albeit at a slower pace than their predecessors. When compared to renters, over 50% of millennials are homeowners, making them a key demographic for the premier mortgage team located in their area to focus on.

Nonetheless, millennials encounter several obstacles on their path to homeownership. Factors such as:

Delayed marriage

Racial and ethnic financial challenges

Increased debt burdens

A lack of affordable entry-level homes

Limited housing inventory

Escalating interest rates

High housing prices

All play a role in affecting millennials’ homeownership rates and home buying process.

Preferred Locations for Millennial Home Buyers

Millennial home buyers, with their diverse preferences, favor a wide variety of locations. Homeownership rates for millennials exhibit significant variations across cities, with higher rates seen in more affordable Midwest cities and lower rates in expensive coastal areas.

The appeal of Midwest cities for millennial home buyers is largely due to their lower cost of living, more affordable housing options, and emerging high-tech job markets. However, some millennials are still attracted to more expensive urban hubs like New York, NY and San Jose, CA, reflecting their desire for a mix of affordability and urban amenities.

Reasons for Millennial Home Purchases

Millennials are driven by various reasons when deciding to buy homes. Financial flexibility is one such factor as it allows millennials to adjust to evolving market conditions, seize opportunities, and make well-thought-out choices when purchasing homes.

Another key reason why millennials purchase homes is to accommodate their pets. Many millennials prioritize the needs of their pets when purchasing a home, seeking out pet-friendly amenities and ensuring sufficient living space for their pets.

Financing Options for Millennial Home Buyers

Millennials, during their home buying journey, have several financing alternatives to contemplate. These include conventional loans, FHA loans, and USDA loans, each with their own eligibility requirements and benefits. The choice of loan type greatly depends on the individual’s financial situation and their chosen property.

Conventional loans are provided by a private mortgage lender and are available to millennial buyers with a strong credit history and consistent income. Those looking to buy property in rural areas may find the USDA loan program appealing, as it does not require a down payment. To increase their chances of mortgage approval, millennials should focus on enhancing their credit score. Alternative sources for a down payment, such as cash gifts from family members or grants, can also assist with the initial expenses of purchasing a home.

Conventional Loans

Conventional loans are a popular choice among millennials with good credit and stable income. To avoid private mortgage insurance with a conventional loan, a minimum down payment of 20% of the purchase price is required. These loans typically require a minimum credit score of 620.

The debt-to-income ratio plays a significant role in loan approval, with most conventional loans requiring a minimum ratio of 45%. The borrowing limit for a conventional mortgage could be up to $500,000, making it a suitable choice for those seeking higher loan amounts.

FHA Loans

FHA loans, a type of government-backed loan, are another viable option for millennials, especially first-time home buyers. The minimum FICO score necessary for eligibility for an FHA loan is 500, which is lower than the requirement for conventional loans.

One of the major advantages of FHA loans is their lower down payment requirement. For an FHA loan with a FICO score of 580, the minimum down payment is only 3.5%. In addition, the maximum loan limit for FHA loans in high-cost areas is considerably high, reaching $1,149,825 in 2022.

USDA Loans

USDA loans are specifically designed for individuals looking to purchase homes in rural areas and offer zero-down payment mortgages. To qualify for USDA loans, the property must be in a rural area and the borrower’s household income must meet specified guidelines.

Lenders typically require a minimum credit score of 640 for USDA loans. Despite the associated fees, such as an upfront 1% guarantee fee and a 0.35% annual guarantee fee, USDA loans are attractive to millennial home buyers due to their lower interest rates compared to conventional and FHA loans and the absence of a down payment requirement.

The Role of Technology in Millennial Home Buying

Technology has brought about significant changes in many sectors, real estate included. Millennials, being digital natives, heavily rely on technology throughout their home buying journey. A significant 65% of younger millennials utilize the internet to find and secure their homes, and a considerable number of younger generations feel comfortable with the idea of purchasing a home online.

Even though younger millennials lean heavily on technology, they also appreciate the individualized help and proficiency of a real estate agent. This blend of self-reliance and professional assistance is a unique trait of millennial home buyers.

Online Home Searches

For millennials, online home searches have changed from being an exception to a standard practice. This trend has grown significantly over the years, with 60% of millennials commencing their home search online.

When using online home search platforms, millennials appreciate photos and detailed property information. They also value the convenience of viewing homes at their own pace and the ability to perform tasks such as virtual property tours, online negotiations, and signing contracts digitally. Favorite platforms among millennials include Zillow, Realtor.com Real Estate, Redfin Real Estate, Trulia, Homes.com, and Rocket Homes.

Virtual Tours and Online Transactions

The popularity of virtual tours has seen a steady rise in recent years. These tours provide a comprehensive view of a property, allowing prospective buyers to virtually explore a space from the comfort of their own homes.

Apart from convenience, virtual tours also facilitate quicker decision-making and generate more leads. Several platforms offer virtual tours, including:

ThingLink

Kuula

iGUIDE

Nodalview

Fusion

VR Maker

Panoee

CloudPano

iStaging

Tourwizard

My360

Roundme

EyeSpy360

The COVID-19 pandemic has further boosted the use of virtual tours, with businesses reporting a 400-500% increase in bookings.

For tips on creating virtual tours, see our blog: https://www.quickcommissionadvance.com/blog/the-ultimate-guide-to-virtual-tour-real-estate-how-to-create-stunning-360-degree-tours/

Overcoming Challenges Faced by Millennial Home Buyers

While millennials are a significant demographic in the housing market, they face unique challenges when it comes to home ownership, such as student loan debt and saving for a down payment. Certain programs, like the Purchase Plus Conventional Loan program and the BorrowerSmart Conventional Loan program offered by Millennial Home Loans, aim to alleviate these financial obstacles. Millennial home lending solutions like these are crucial for this generation’s success in the housing market.

Student Loan Debt

Student loan debt is a major hurdle for millennials striving for homeownership. The average student loan debt for millennials is $40,614. This burden often leads to a high debt-to-income ratio, which can result in increased interest rates or even rejection of home mortgage applications. As a consequence, managing mortgage payments becomes a challenging task for these individuals.

However, there are strategies millennials can employ to effectively handle their student loan debt while simultaneously saving to purchase a home. They can explore opportunities to boost their income and cut down on expenses, adopting the mindset that debt forgiveness may not be an option.

Saving for a Down Payment

Another major hurdle for millennial home buyers is accumulating enough savings for a down payment. On average, millennials aspiring to own a home have not saved any funds for a down payment, and only a small percentage have accumulated enough savings for the conventional 20% down payment.

Despite this challenge, many millennials receive assistance towards a down payment, typically from their parents. Millennials are typically facing average home prices ranging from $250,000 to $315,000, further illustrating the financial challenges they face.

Tips for Millennial Home Buyers

For millennial home buyers going through the home buying process, certain tips can ease the journey. These include working with a knowledgeable real estate agent, understanding mortgage rates and loan eligibility, and preparing for unexpected costs.

Understanding mortgage rates is particularly important, as they are influenced by various factors including:

Credit score

Loan-to-value ratio

Inflation

Market conditions

The cost of borrowing

Bond yields

Risk

It is advisable to consult reputable sources such as US News and Bankrate for the latest rates.

Working with Millennials as a Real Estate Agent

To provide effective assistance to millennials on their home buying path, real estate agents need to stay informed about their buying trends and preferences by referring to resources like the sellers generational trends report. Understanding their preferred communication methods, such as text messages or Skype, is crucial.

Moreover, real estate agents should be aware of the specific home features or amenities that appeal to millennial homebuyers, such as:

Smart home technology

Open floor plans

Updated kitchens and bathrooms

Energy-efficient appliances

Outdoor living spaces

Nearby amenities

Understanding Mortgage Rates and Loan Eligibility

For millennial home buyers, it’s essential to comprehend mortgage rates and loan eligibility. The two primary categories of interest rates for mortgages are fixed and variable (adjustable). A fixed-rate mortgage offers stability and predictable monthly payments, while an adjustable-rate mortgage offers lower initial rates but carries the risk of potential future rate increases.

Determining loan eligibility involves understanding various factors including:

Credit score

Income

Debt-to-income ratio

Collateral

Lenders have individual requirements for approving loans, and some may consider applicants with lower credit scores, as assessed by a loan officer.

Preparing for Unexpected Costs

Anticipating unforeseen expenses is key to ensuring a seamless transition into homeownership. Within the first year of homeownership, millennials could potentially face unforeseen expenses including:

electricity

heating

water

potential roof replacements

These expenses have an average cost of approximately $3,600.

It is advisable for millennials to:

Allocate approximately 1-2 percent of their home’s value annually to address unforeseen homeownership costs

Allocate up to 5% of their income for home maintenance

Establish a dedicated account for unforeseen repairs

This will help them efficiently manage their funds.

Summary

In conclusion, millennial home buyers play a vital role in today’s real estate market and have unique preferences and challenges. Understanding these trends, financing options, and the role of technology in their home buying process can help real estate professionals better serve this significant demographic. As a millennial home buyer, being aware of these trends, understanding mortgage rates and loan eligibility, and preparing for unexpected costs can make the home buying journey more manageable.

Frequently Asked Questions

Is it really harder for millennials to buy a house?

Yes, it is really harder for millennials to buy a house. They are becoming homeowners at a slower pace than previous generations due to barriers like high down payments and tighter lending criteria, but it’s still a valuable goal to pursue.

Which demographic is buying the most homes?

Baby boomers are currently the demographic buying the most homes, surpassing millennials in 2022, according to research by the National Association of Realtors. This shift is attributed to baby boomers being repeat buyers with housing equity.

What is the largest generation of home buyers?

Baby Boomers are now the largest generation of homebuyers, making up 39% of homebuyers in 2022, surpassing Millennials, according to the latest report from the National Association of Realtors.

What percentage of millennials would buy a home based on listing photos?

Approximately 44% of millennials said they would buy a home based on listing photos alone, as revealed in a recent survey by Clever Real Estate. This indicates the significant influence of listing photos on millennial homebuying decisions.

Leave a Reply