As we venture into 2023, the housing market is undergoing significant changes influenced by various factors, such as digital transformation, migration trends, and government policies. In this comprehensive analysis, we will explore the latest real estate trends shaping the real estate landscape and provide valuable insights to help you navigate the ever-evolving market successfully.

Key Takeaways

Real estate is undergoing digital transformation, driven by technology and accelerated by the pandemic.

Migration from urban to suburban areas has caused a surge in demand for suburban housing.

The Sun Belt region offers potential for commercial real estate investment and growth due to increased popularity.

Digital Transformation in Real Estate

A remarkable digital transformation is unfolding within the real estate industry. This process leverages technology to enhance efficiency and effectiveness in the sector, employing virtual property tours, online mortgage options, and digital neighborhood networking. The COVID-19 pandemic accelerated this digitization, making these advances increasingly common.

Homebuyers stand to benefit from the influence of technology in the current real estate market. Interest and mortgage rates, the persistent challenge of limited housing inventory, steady growth in home prices, and considerations of affordability all play a role in shaping the market.

However, this transformation is not without its challenges. Some of these are: generational shifts, implications of remote work, heightened uptake of technology, access to affordable housing, and the need for localized data and insights.

In response to these evolving demands, mortgage lenders are also undergoing necessary adaptations.

Migration from Urban to Suburban Areas

Driven by the COVID-19 pandemic, a migration from urban to suburban areas has been observed. This is a trend likely to persist through 2023. This shift is contributing to other current real estate trends. Some of these are the growing popularity of the Sun Belt region, a rise in median home prices, and a housing shortage. This shortage is due to strong buyer demand.

This migration is propelled by various factors such as significant interest rate increases and sharp mortgage rate hikes. Fannie Mae predicted that overall home sales in 2023 would decrease by 18.4%. But existing home sales in February 2023 increased by 14.5%. The implications of these changes will continue to reverberate throughout the real estate market, with suburban housing demand on the rise and urban areas experiencing declines.

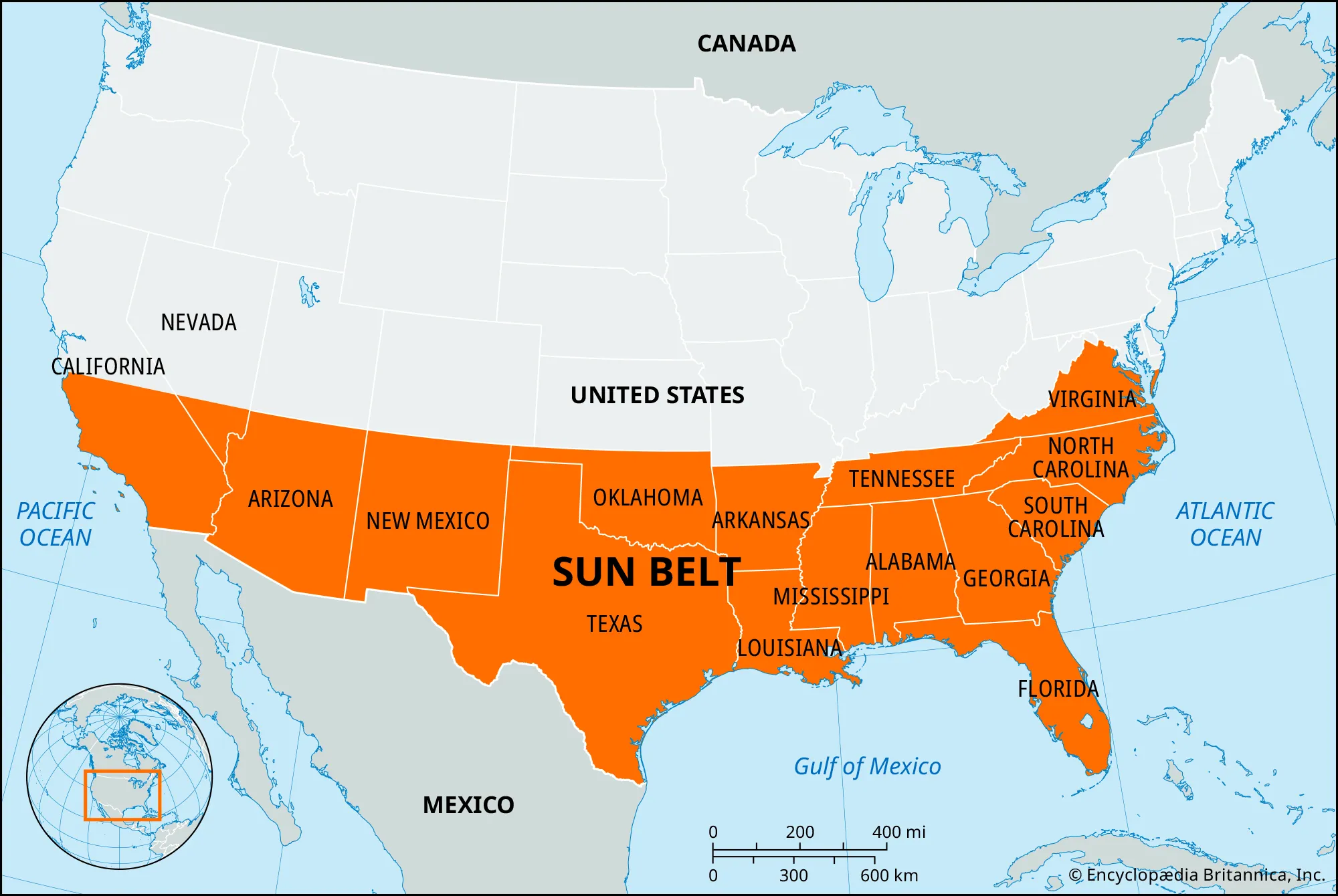

The Rise of the Sun Belt Region

The Sun Belt region, an area extending from California to North Carolina and encompassing 18 southern states, is experiencing a surge in popularity. This growth is driven by increasing relocation and population growth. This is evidenced by the seasonally adjusted annual rate of housing sales.

Cities in the Sun Belt region that are showing promising potential for real estate growth include:

Austin, which is expected to experience the highest level of growth in the US

Phoenix, which is also expected to have significant growth

Nashville, which is expected to have strong real estate opportunities

Dallas, which is among the top ten US cities with potential real estate opportunities

Tampa, another major Sun Belt metropolitan area, which also appears on this list

These cities offer great potential for commercial real estate investment and growth.

Single-Family Housing Demand and Shortages

Housing inventory shortages are emerging due to a rising demand for single-family homes in suburban areas. Factors contributing to this demand include:

The pandemic-related demand for housing

Millennials entering the homeownership phase of their lives

Millennials looking to purchase their first house or start a family.

According to the current housing market forecast, the market will continue to experience a shortage, with a predicted decline in new home constructions by over 25% through 2023, before rebounding with a 24% increase in 2024. Sales were still up by 5.8% in comparison to the same month the preceding year. And the percentage increase in existing inventory in March 2023 compared to the previous year is 5.4%.

This housing shortage necessitates an escalation in construction efforts to satisfy the burgeoning housing supply demand.

Continued Growth in Home Prices

Owing to the limited supply and high demand, home prices are projected to keep rising throughout 2023.

Home prices are expected to remain on an upward trajectory through 2023, with the median home price seeing an annual increase of 6.3%. This continued growth in home prices can make it challenging for some buyers to enter the market, especially first-time homebuyers.

Mortgage Rate Fluctuations

With potential increases affecting homebuyer affordability and market activity, mortgage rates are projected to experience fluctuations for some time. The current average 30-year fixed mortgage rate is above 7%. Interest rates increased from 2021’s all-time low average (2–3%) to more than 6–7% in November 2022. They continue to rise.

These fluctuations in mortgage rates will play a significant role in shaping the future housing market. For example, the Mortgage Bankers Association anticipates a decline in mortgage originations and muted activity for the remainder of 2023 and early 2024, potentially avoiding a housing market crash.

Buyers and sellers in the real estate market need to keep a close eye on these fluctuations to make informed decisions about home purchases and sales.

Rental Property Market Shifts

Shifts in the rental property market are evident. These are marked by declines in urban areas and emerging opportunities for real estate investors in suburban and rural markets. The rental market for both residential and commercial properties in large cities has experienced a decrease.

Investors have the opportunity to invest in struggling rental properties that may become profitable again after renters return to big cities post-pandemic. Such investments could potentially be lucrative for investors. Furthermore, there is an opportunity to repurpose vacant commercial properties, such as hotels and retail buildings, into housing units.

As the transition from urban to suburban areas continues to impact the rental market, investors will need to adapt their strategies to capitalize on these shifts.

Government Policies and Their Effect on the Housing Market

In shaping the 2023 housing market and tackling affordability challenges, government policies like mortgage standards and affordable housing initiatives have been instrumental. Stricter mortgage standards could make it more challenging for some individuals to meet the requirements for a mortgage. This may hinder their ability to become homeowners.

Affordable housing policy could have a significant impact on the real estate market in the near future. Such policies could facilitate increased access to affordable housing options, making homeownership more attainable for a wider range of people. In addition, affordable housing policies may incentivize developers to include affordable units in their projects, affecting the overall supply and demand dynamics in the real estate market.

Regional Variations in Real Estate Trends

Real estate trends will vary regionally, affecting the real estate housing market in different ways, with some areas experiencing more pronounced shifts in demand, pricing, and inventory. For example, the Northeast showed the highest price growth of 5.2%, while the West had the weakest growth rate of 1.8%.

The West (5.9%) and Southwest (-3.6%) regions have the lowest home values. In contrast, Chicago (+4.4%), Cleveland (+4.0%), and New York (+3.8%) were the metropolitan areas with the highest performance. Understanding these regional variations is crucial for buyers and sellers to make informed decisions in the ever-changing real estate landscape.

Strategies for Navigating the 2023 Real Estate Market

To navigate the shifting landscape successfully, buyers and sellers in the 2023 real estate market should contemplate various strategies. Working with experienced agents is vital, as they can provide valuable insights and guidance in understanding the evolving environment. The RamseyTrusted program recommends the most qualified real estate experts in their areas to help buyers and sellers.

Being realistic about pricing is another crucial strategy when considering the 2023 real estate market. Identifying potential discounts and negotiating favorable deals on homes currently listed will be essential for success.

Lastly, staying informed about market trends is paramount in the 2023 real estate market. Stakeholders should vigilantly observe forthcoming reports to evaluate the market’s vitality and potential alterations in policy and strategy.

Summary

In conclusion, the 2023 real estate market is marked by significant changes influenced by various factors such as digital transformation, migration trends, and government policies. By understanding these trends and employing effective strategies, buyers and sellers can navigate the shifting landscape successfully. As a real estate agent, one should stay informed, be realistic about pricing, and work with experienced professionals to make the most of the opportunities presented in this ever-evolving market.

For more information on housing market indicators, see our blog: https://www.quickcommissionadvance.com/blog/essential-housing-market-indicators-for-real-estate-agents-in-2023/

Frequently Asked Questions

What is the real estate market outlook for the near future?

2023 has been challenging so far for the real estate market, with mortgage rates remaining above 6% and affordability issues continuing to weigh down buyers. As such, home prices are likely to stay mostly the same with some markets experiencing a small increase or decrease. However, Morgan Stanley recently revised their forecast from a 4% decrease in national home prices to up to 5% growth, and growth has been seen.

Are California home prices dropping?

Home prices in California are not dropping; rather, they are rising. The California Association of Realtors reported a 3% increase and Redfin data showed a 5% rise between August 2022 and August 2023. CAR estimates also predict an increase of 6.2% to $860,300 in 2024.

Will 2024 be a good time to buy a house?

2024 is likely to be a challenging time for first-time home buyers, as mortgage rates are expected to remain elevated. Affordability remains an issue, so prospective buyers may benefit from professional assistance with doing research before purchasing a house in that year.

What are home trends for 2023?

For 2023, home decor trends have focused on bold colors, natural materials, wallpapers, living finishes, mixed metals, traditional styles, jewel box laundry rooms, and mixing old and new for an updated look.

What is the impact of digital transformation on the real estate market?

Digital transformation has revolutionized the real estate market, bringing efficiency, effectiveness, virtual property tours, online mortgage options, and digital neighborhood networking.

Leave a Reply